Talk Tax To Me: Understanding Business Taxes Without Wanting to Scream

The biggest topic on my clients’ minds seems to be business taxes. No one wants to talk about them, but everyone is stressing out about them. Am I right?

The thing is, while business taxes aren’t necessarily “fun,” they don’t need to be painful either. Having a good system in place to manage your taxes will ensure that you’re on top of your deadlines. Plus tax time won’t be stressful and you won’t overpay or miss out on beneficial savings.

Income Taxes

If your business is profitable, you’re probably going to pay business taxes on those profits. How do you calculate profit? Simply, your revenues (the money that comes in) minus your business expenses. “Taxable income” is the amount of profits subject to tax. Most times, your taxable income is your business profits. One likely reason these could be different is if some of your business expenses are not deductible for tax purposes.

Business Income Tax Rates

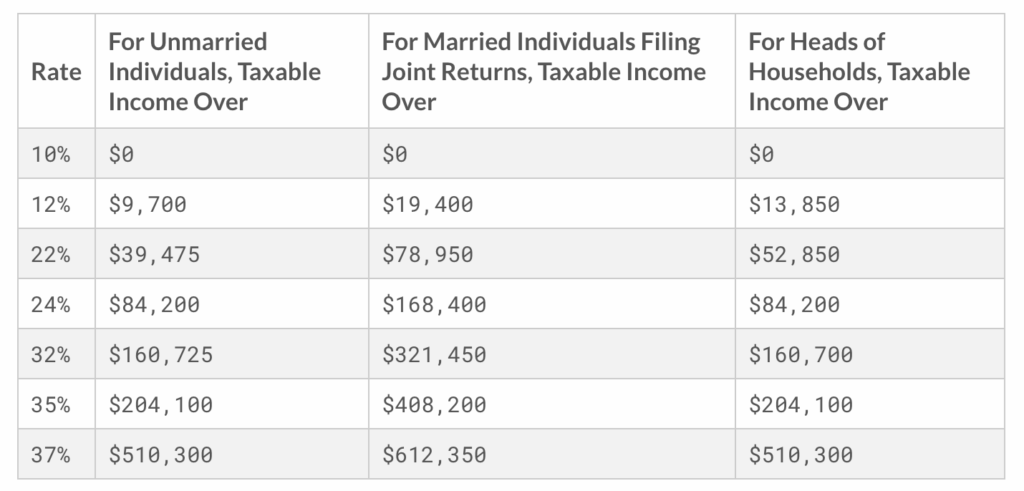

The U.S. tax system is a progressive system. This means that higher amounts of income are subject to a larger tax rate. It’s important to understand that these higher rates are not applied to ALL taxable income, but only to the portion of income above certain thresholds. If you are a sole proprietor or your business is an LLC, partnership or S corporation, your business income is taxed at the individual level. As such, individual tax rates apply.

Here are the individual income tax brackets for 2019:

So if you are unmarried, all of your income up to $9,700 is subject to a 10% tax rate. Your income between $9,700 and $39,475 (so $29,775) is subject to a 12% tax rate. So if you made $35,000 in 2019, your total tax liability would be:

The first $9,700 = $970 (10% rate)

The remaining $25,300 = $3,036 (12% rate)

Total tax liability = $4,006 (effective 11.5% rate)

Keep in mind, that your total taxable income factors in both your business income and any other income you may have – from a job, a spouse’s income, investments, etc.

If your business is a sole proprietorship, LLC, partnership or S corporation, you will pay taxes on your business income on your individual tax return. C Corporations pay taxes on their business income on their own return (and then shareholders pay taxes on any dividends that are distributed).

And while most individuals file their tax returns in April of the following year, you likely need to pay quarterly estimated taxes during the year. To learn more about quarterly estimated taxes, read this post.

State Income Tax

Most states tax business income similar to how it is taxed at the Federal level (albeit at different rates). However, some states have what is called a “gross receipts tax.” A gross receipts tax is a tax on the gross receipts of the business, instead of on the business income.

Some states also charge a “franchise tax” to corporations. Sole proprietors are usually not subject to the franchise tax.

Sales Tax

Sales tax is a tax on the sale of certain products and services. The seller usually collects this tax at the time of purchase. The seller then pays the tax to the tax authorities (in the U.S., those would be the states, cities/towns and local municipalities).

Nexus

Whether or not a sale is subject to sales tax depends on a few factors. First, you need to determine where you have nexus. “Nexus” exists when your business or the transaction has a connection to the state. In the U.S., sellers are required to collect sales tax from buyers in every state where they have nexus. What determines nexus varies by state, but in general, the following can create nexus:

- A physical location, such as an office, warehouse or retail location

- Employees, contractors, salespeople or other personnel doing work for your business

- Storing inventory

- Economic nexus (i.e., sellers who have exceeded a certain threshold in dollars or number of transactions in that particular state)

- Affiliates, or other persons who advertise your product in exchange for a portion of the profits

- A drop-shipping or third party shipping relationship

- Selling products on-site at a tradeshow or other event

Note that if you have sales tax nexus in a particular state, you are required to collect sales tax from all buyers in that state on every sales channel you use.

Economic Nexus

Economic nexus is a fairly new concept, but many states have adopted laws that require a seller to pay sales tax in that state because the seller either sells a certain dollar amount or a certain number of transactions in that state. Other states have indicated that they intend to adopt economic nexus laws, so stay up-to-date on the laws in the states you sell in.

While the amounts for economic nexus do vary by state, the most common is $100,000 in sales or 200 transactions each year. To check the nexus rules in each state, I recommend Taxjar’s Sales Tax Guide here.

Taxable Transactions

Once you’ve determined where you have nexus, next you need to determine if the products or services you sell are even subject to sales tax. Most “tangible property” (furniture, jewelry, office products, home goods, etc.). is subject to sales tax. Items considered to be “necessities” such as groceries or non-luxury clothing are usually exempt.

Digital products (such as online courses and e-books) and services are generally not taxable in most states. However, because the laws vary by state, it’s important to confirm the rules in every state where you have nexus. Also, keep in mind that the rules for some items are not “all or nothing.” For example, in some states, clothing up to a certain dollar amount is not taxable, but the amount of the transaction above that threshold is.

Paying Sales Tax

Once you’ve determined your transactions are subject to sales tax, you need to register for a sales tax permit in each state where you are required to collect. After you apply with the state for your permit, they will inform you of the frequency with which you must make payments. The state will likely also provide you with a resale certificate, which allows you to purchase items tax-free that are intended to be resold.

In-State Sales

If you are selling to buyers within your state, then you need to be aware of sourcing rules. Sales tax sourcing rules vary by state. Some states require “origin-based sales tax collection,” which means that sellers in these states are required to collect sales tax based on the seller’s business location. For example, if you are located in Phoenix, Arizona (currently an origin-based state), then you would be required to collect sales tax on sales made to other buyers in Arizona based on the rates in Phoenix, even if the buyers were located in other parts of the state.

Most states follow “destination-based sales tax collection” which means the seller charges sales tax based on the buyer’s shipping address.

Out-of-State Sales

If you have nexus in a state where your business is not based (so perhaps because you have employees there or met the economic nexus threshold), the rules are different. In these cases, usually, the sales tax rates are based on the shipping address of the buyer. The three exceptions are currently Arizona, California and New Mexico. Check out Taxjar’s Sales Tax resources for more info on each state.

Taxing Shipping Charges

Some states require you to calculate the sales tax on the purchase price of the item plus shipping charges, whereas other states don’t tax shipping charges. Taxjar offers a great resource for determining where shipping is subject to tax.

Dropshipping & Sales Tax

As options for e-commerce sellers expand, so do the tax complications. Take the example of dropshipping, where you sell a product on your website, but a third party creates and ships the product for you (for example, on-demand t-shirt printing). What’s essentially happening in this example is the customer is purchasing the item from you, you are purchasing the item from the vendor, and the vendor is shipping the item to the customer.

In this example, if your third party vendor has nexus in your state, they are required to collect sales tax from you unless you provide them with your resale certificate. If your customer is located in a state where you have nexus, you are required to charge them sales tax on the sale.

Third-Party Shipping Providers

What about the case where you create the products but a third-party handles order fulfillment in shipping? Be careful – this could create nexus in certain states. For Amazon sellers this can get tricky as they have warehouses and fulfillment centers all over the United States. \

Collecting Sales Tax

If you are required to collect sales tax, it’s important to set up a good system for collecting those payments from each customer. If you sell online or use a POS, those systems typically allow you to set up sales tax collection.

Filing and Paying Sales Tax

How frequently you must file your sales tax returns and pay the taxes depends on the state and local jurisdiction. However, this is usually done monthly or quarterly. Some states even offer discounts for sellers who pay on-time, and these discounts can really add up over time.

Many states require you to file a return even if you don’t owe any sales tax.

Self-Employment Tax

If you are self-employed, then you likely need to pay self-employment tax. This tax is essentially the same as the payroll taxes that are withheld from the paychecks of employees. But because you are no longer an employee of someone else, you are responsible for this tax.

Currently, the self-employment tax is 15.3% of your self-employment earnings. This represents two separate taxes: 12.4% for Social Security and 2.9% for Medicare. All of your self-employment taxable income is subject to the Medicare tax; only the first $132,900 (in 2019) is subject to Social Security tax. There is also an additional 0.9% Medicare tax on income over $200,000 (single) or $250,000 (married filing jointly).

Who needs to pay?

Generally, you are subject to self-employment tax if your net self-employment earnings are $400 or more. You do not need to pay self-employment tax on income where taxes were withheld on your behalf.

How do you calculate net earnings?

This is actually fairly simple (yes!). Remember we talked about that taxable income before? Your net earnings subject to self-employment tax are essentially your revenues minus your tax deductions (so your business taxable income).

The IRS also gives you a benefit in the amount of self-employment earnings subject to the tax. Essentially, they give you a deduction for the employer’s portion of the self-employment tax (so half, or 7.65%), such that only 92.35% of your self-employment earnings are subject to self-employment tax.

Paying Self-Employment Taxes

When you file your annual tax return, you will also file Schedule SE to calculate and report your self-employment tax. However, keep in mind that you do need to pay in self-employment tax quarterly similar to income tax.

Employment Taxes

If you hire employees, it’s your responsibility to collect and pay employment taxes on their behalf. I highly recommend utilizing a payroll service that does this for you, so that you don’t end up making any errors and underpaying.

Federal Income Tax

While this isn’t a tax you have to pay as the employer, it is one you have to withhold for. The IRS puts out Publication 15, the Employer’s Tax Guide, with guidance on how much to withhold from each employee’s paycheck.

Social Security and Medicare Taxes

We talked about these above, but let’s do a quick recap here. Remember I said the total self-employment taxes were 15.3%? Well, half of that represents the employee’s portion and the other half represents the employer’s portion.

So when you have employees, you need to withhold Social Security (6.2% on the first $132,900) and Medicare (1.45% on all income). However, you also have to pay in, as the employer, that same 6.2% for Social Security and 1.45% for Medicare. And don’t forget that if their earnings are above $200,000 for single and $250,000 for married filing joint, you need to withhold the 0.9% Additional Medicare Tax.

Federal Unemployment (FUTA) Tax

Employers are responsible for paying FUTA, which is currently 6% on the first $7,000 of wages. However, you can generally take a credit, up to 5.4% of the FUTA taxable wages, for any unemployment taxes paid into state unemployment funds. Note that this tax CAN NOT be withheld from employees’ paychecks; it must be paid by the employers.

State Employment Taxes

Many states have their own unemployment taxes. Since the laws vary greatly by state, I highly recommend you contact your state’s Department of Revenue to confirm their employer taxation requirements.

Property and Excise Taxes

Property Taxes

If your business owns any property, you may be subject to property taxes on the assessed value of the property. Property tax laws vary by state and local jurisdiction and are usually assessed at the city or county level.

Excise Taxes

Excise tax is a tax on the use of certain goods or activities and can be owed at the Federal and/or state level. For example, many states impose excise taxes on automobiles.